Funding

Continuation of excellent market access

Our strong credit ratings and the special regulatory treatment afforded to our bonds by virtue of the Federal Republic of Germany’s guarantee for Rentenbank’s obligations allow us to maintain our excellent market access across all maturities.

Measured by the margin over 6-month Euribor, our funding costs were higher than in the previous year. This increase resulted from the general rise in credit spreads triggered by the higher issuance volumes of state issuers in Europe and by the beginning run-off of bond holdings by the ECB. We were still able to raise short-term liquidity less than one year at yields at the level of €STR swap rates through our Euro Commercial Paper Programme (ECP Programme).

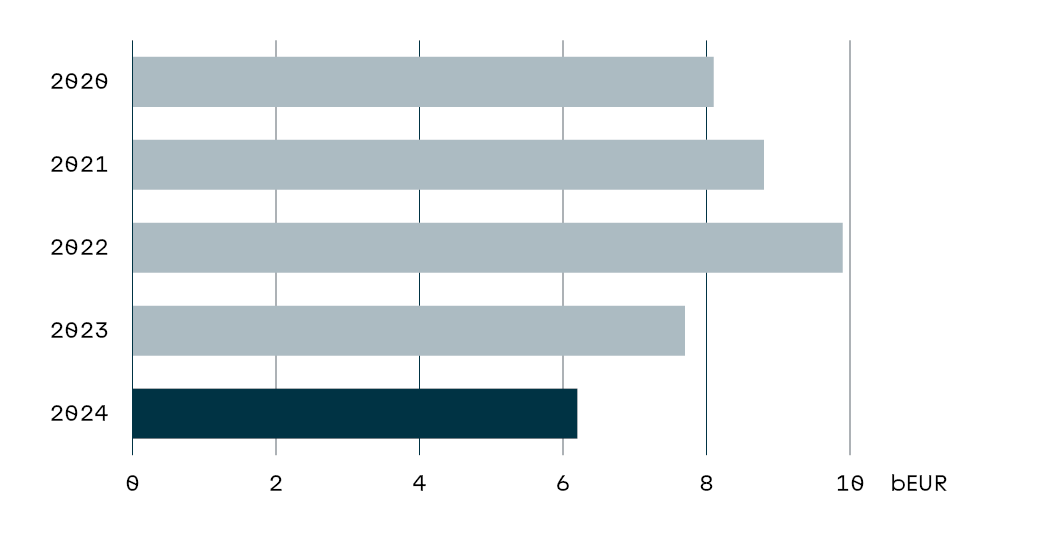

Lower issue volume

We raised EUR 8.2 billion (2023: EUR 10.5 billion) in funds with maturities of longer than two years in the capital markets in the past financial year. The funds were raised by the following funding instruments:

| Medium- and long-term issue volume (longer than two years) | ||||

| bEUR 2024 | bEUR 2023 | Share in % 2024 | Share in % 2023 | |

| EMTN | 6.2 | 7.7 | 75.5 | 73.1 |

| of which green bonds | 0.0 | 1.0 | 0.0 | 9.5 |

| Global bonds | 1.4 | 2.1 | 17.0 | 20.1 |

| AUD-MTN | 0.6 | 0.7 | 7.5 | 6.8 |

| Total | 8.2 | 10.5 | 100.00 | 100.00 |

Vital importance of the EMTN Programme

The Euro Medium-Term Note Programme (EMTN Programme) is our most important funding instrument, with a programme capacity of EUR 70 billion. The programme capacity used at the end of 2024 was EUR 56.6 billion (EUR 57.9 billion). Using standardised documentation, we can float issues of different amounts, maturities, and structures in many currencies under the EMTN Programme. We used the programme in the past financial year to raise exclusively medium- and long-term funding.

Medium- and long-term EMTN issues

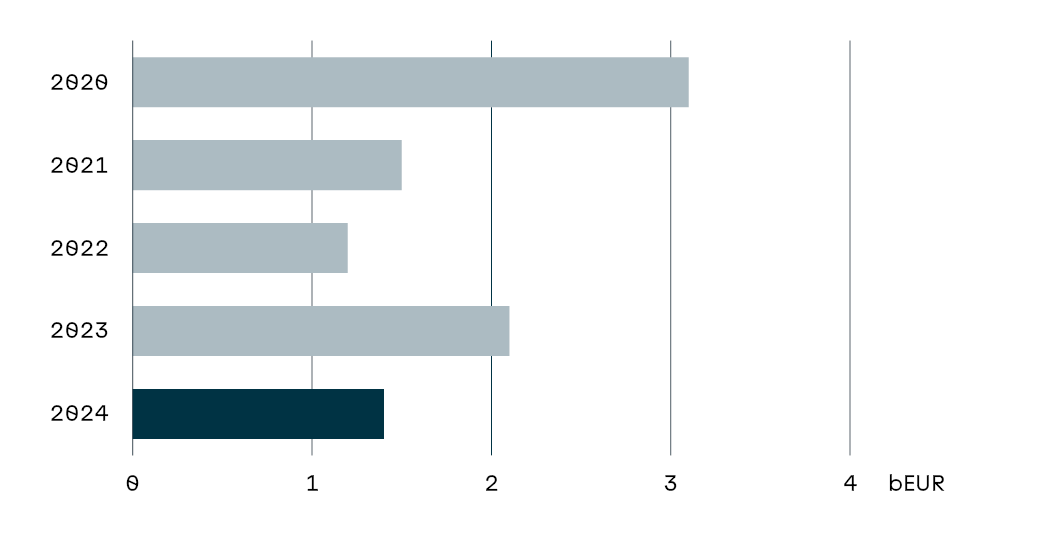

Successful US dollar global bonds

The global bonds registered with the US Securities and Exchange Commission (SEC) play an important role in our funding activities. The registration under “Schedule B” gives us access to the US market. This registration is only granted to sovereign states and quasi-sovereign issuers, underscoring our “agency” status in the international capital market. We issued a five-year global bond for USD 1.5 billion in 2024.

Issuance of global bonds

Lower issue volume in the “kangaroo” market

Under our AUD MTN Programme, we issued bonds in the total amount of AUD 1.0 billion (AUD = Australian dollars), equivalent to EUR 0.6 billion (EUR 0.7 billion), in 2024.

Rentenbank had an outstanding bond volume of AUD 7.6 billion at the end of 2024.

Higher average utilisation of the ECP Programme

Issues from our EUR 20 billion ECP Programme continue to be of major importance for short-term funding. These are bearer notes maturing in less than one year, which are usually issued in discounted form, meaning without interest coupons. The average annual programme utilisation was EUR 10.9 billion in 2024 (EUR 10.2 billion). The programme utilisation at the end of 2024 was EUR 8.5 billion (EUR 8.6 billion).

Rentenbank bonds

Based on the Credit Risk Standardised Approach of the Capital Requirements Regulation (CRR), EU banks do not need to allocate capital to back their loans to and receivables from Rentenbank. The zero risk weight resulting from the German Federal Republic’s guarantee is also possible in many countries outside of the EU such as in the United Kingdom, Norway and Switzerland, the United States and Canada, Australia, and New Zealand.

Banks were again the most important investor group

The percentage of our medium- and long-term issue volume placed with banks was 55% in the past financial year (57%). This group of buyers purchases the highest-rated zero-weight notes offering attractive spreads, which are recognised as liquid assets. In addition, central banks and other government agencies purchased a significant percentage of these funding instruments. This percentage rose to 35% (30%) in 2024.

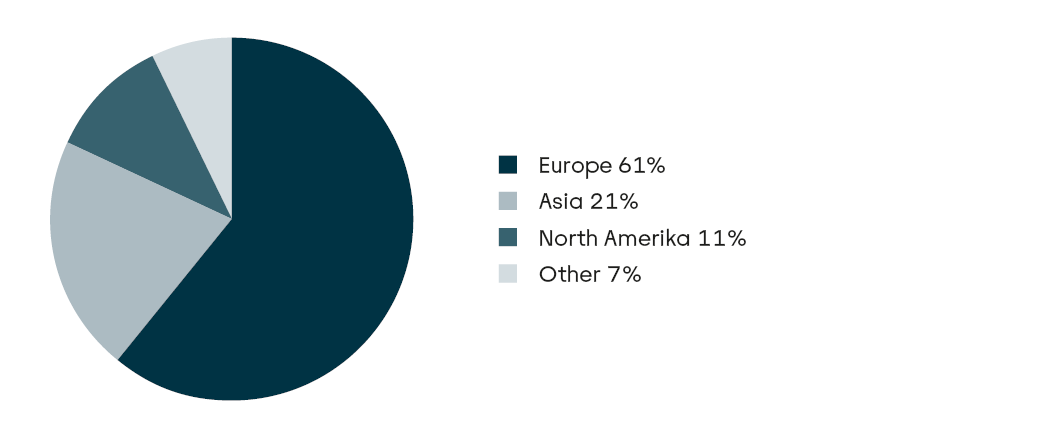

The share of German investors fell to 21% from the previous year (30%). We placed 40% (39%) of our bonds with other European investors. At 21%, the demand of Asian buyers was about the same as in the previous year (20%). The share of US investors rose to 11% (6%). Another 5% (3%) of our issues were placed with investors in the Middle East and Africa, and 2% (2%) in New Zealand and Australia.

Breakdown by region of medium- and long-term issues in 2024

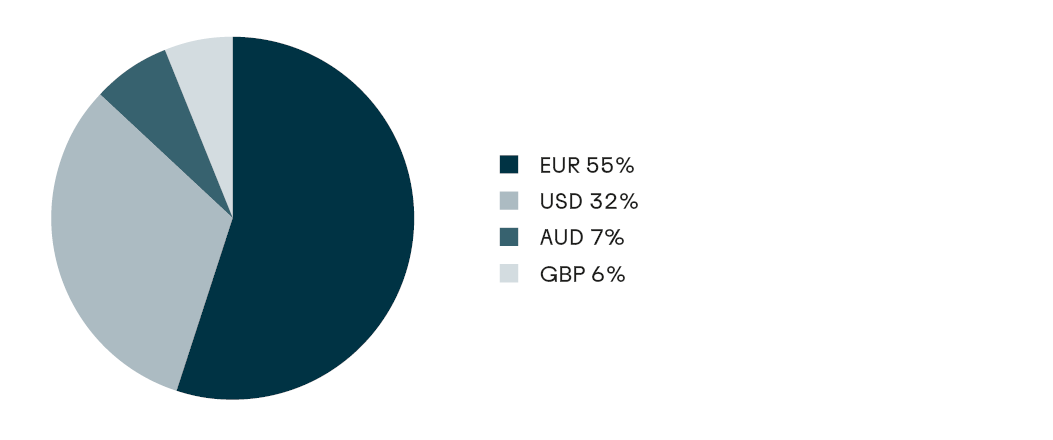

Euro was the most important issue currency

Our medium- and long-term issue volume was divided among four currencies in the past financial year. The most important issue currency was the euro, at 55% (66%), followed by the US dollar, the share of which rose to 32% (27%). The Australian dollar came in third place, at 7% (7%). The British pound accounted for 6% of our total issue volume.

Breakdown by currency of medium- and long-term issues in 2024

Rentenbank issues are classified as “liquid assets” …

In the European Union, the bonds of promotional banks are classified as “liquid assets” for purposes of bank regulatory reporting pursuant to the CRR. Thanks to the German Federal Republic’s guarantee, our bonds fulfil the regulatory requirements of “Level 1 assets” in the EU. The same applies in some countries outside of the EU.

… and recognised as eligible collateral

Our euro-denominated exchange-listed issues meet the requirements of the European System of Central Banks (ESCB) to qualify as Category I collateral. Our bonds are classified as belonging to Liquidity Category II. Only the bonds of central banks and sovereign states are assigned to the higher Category I. Liquidity Category II includes the bonds of supranational institutions and the issues of institutions with a public promotional mandate. Moreover, the Reserve Bank of Australia recognises our “kangaroo bonds” and the Reserve Bank of New Zealand our “kauri bonds” as eligible collateral. Our issues also enjoy a preferential status in the private repo markets. For example, Eurex Clearing AG accepts our securities as collateral for the “GC Pooling ECB Basket”.

Rentenbank bonds are included in the most important bond indices

Our large-volume euro- and US-dollar-denominated bonds are included in the most important bond indices, including the Bloomberg Euro-Aggregate Government Related TR Index and the Bloomberg US Aggregate Bond Index. These indices measure the performance of international market segments. Many institutional investors are measured by the performance of these indices and therefore they manage their investments and invest their assets on that basis.

Money market operations

We employ a number of instruments to fund short-term assets, manage liquidity, and hedge short-term interest rate risks. Short-term funds can be raised by way of the ECP Programme and EMTN Programme, by way of overnight deposits and term deposits in the interbank market, and by way of the ECB’s refinancing facilities. We also manage interest rate risk through the use of derivatives.

Derivatives to hedge market price risks

To hedge interest rate and currency risks, we entered into swaps amounting to EUR 16.9 billion in the past financial year (EUR 22.2 billion). Of this total, EUR 13.2 billion (EUR 18.7 billion) consisted of interest rate swaps and EUR 3.7 billion (EUR 3.5 billion) consisted of cross-currency interest rate swaps We also hedged our foreign currency ECP issues with currency swaps (FX swaps).

We only use derivatives as hedging instruments for existing or foreseeable market price risks. We limit the credit default risk of the derivatives we employ by means of collateral agreements with all swap counterparties.

Rentenbank remains classified as a non-trading book institution

Rentenbank does not keep a trading book according to the definition of the German Banking Act (KWG) and Article 4 (1) no. 86 CRR. We therefore classified our bank as a non-trading book institution and notified this classification to the BaFin and the Bundesbank already in 1998. We still do not hold any positions with trading intent according to Article 4 (1) no. 85 CRR. We assign all transactions to the banking book.