Introduction

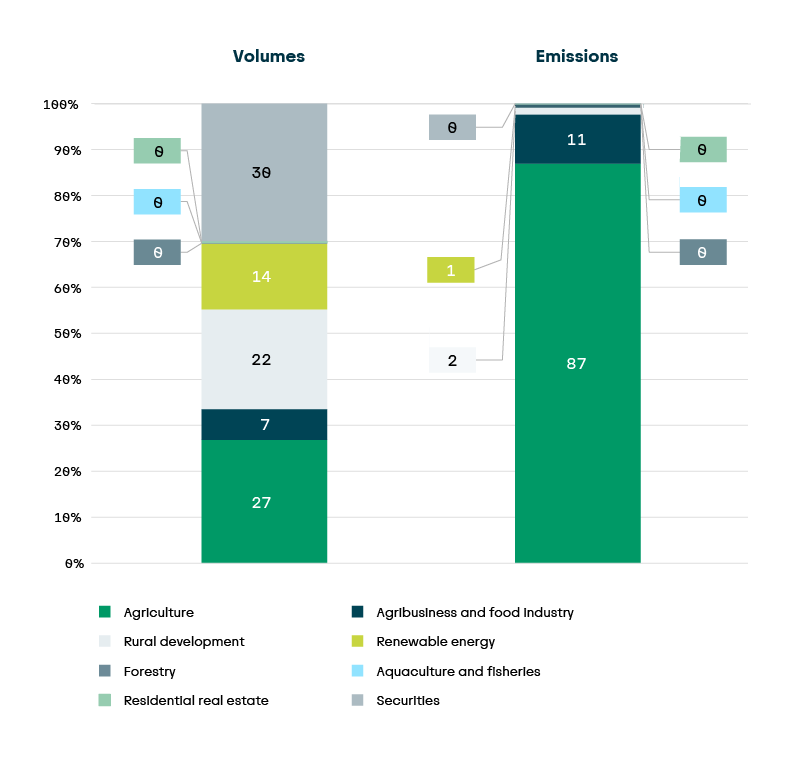

Landwirtschaftliche Rentenbank is committed to the 1,5-degree target of the Paris Climate Agreement. It has set decarbonisation targets both for its own internal operations and for its financing activities. Landwirtschaftliche Rentenbank has prepared its own CO2 emissions inventory according to the GHG Protocol. This analysis shows that nearly 87% of our Scope-3-emissions arise from our agriculture financing activities (see Figure 1). The financing portfolio emissions were calculated with the aid of PCAF. Based on this one-sided distribution and the high importance of this sector for us, we will focus initially on decarbonising our agriculture portfolio.

The business model of Landwirtschaftliche Rentenbank is based on the lending bank principle, under which the lending banks are our direct business partners. As a promotional bank for agribusiness and rural areas, however, we have decided to focus our efforts on decarbonising the activities of our ultimate borrowers in order to help them master their transformation in the best way possible.

We are well aware of the conflicting goals within agriculture, between food security, climate change mitigation, the supply of renewable raw materials, and the preservation of natural resources. Moreover, it is unlikely in our opinion that a net zero target can ever be met in the agriculture sector due to the biological processes involved.

That is why we have placed the sustainable transformation of agriculture and the promotion of agricultural practices that contribute to climate change mitigation at the centre of our Climate Strategy. Our decarbonisation efforts are guided by the projections of the German Federal Climate Action Act and the sector targets set by the German federal government.

We have set targets for the reduction of portfolio emissions, which are to be achieved by means of the measures described in Chapter 4. Our portfolio also encompasses agriculture lending programmes to promote projects that avoid greenhouse gas emissions or sequester carbon on a long-term basis. Such lending programmes are aimed at promoting renewable energy investments, the management and preservation of forest areas, and agricultural practices that promote the growth of humus in the soil. In the future, we would like to expand such financing programmes and increase their share of the overall portfolio.

The present version of our Climate Strategy is based on the data and resources available as of 31 December 2024. It will be updated every year. We will pursue the key aim of improving the quality of the data applied for CO2 accounting in order to establish control instruments within the bank.

Because more than 99% of Rentenbank’s total emissions are classified as financed emissions (Scope-3-Cat. 15), these represent the focus of the bank’s climate strategy. The distribution of volumes and emissions within Category 15 is shown in the figure below:

Volumes and financed emissions in the portfolio (Scope-3-Cat. 15)

Figure 1: Breakdown of volumes and financed emissions in the portfolio