Financed emissions

Financed emissions are calculated in accordance with the PCAF methodology, mainly on the basis of secondary data from the PCAF database. Rentenbank’s financed emissions comprise the Scope-1- and Scope-2-emissions of the borrowers. The Scope-3-emissions of loan recipients are not included in this figure due to the limited ability to control them. To establish a solid data basis for effective decarbonisation control, Rentenbank intends to progressively expand the data basis for CO2 inventory accounting.

A mixed approach is pursued for securities, depending on data availability. Market data are available for some of the securities. When market data were not available, the level of emissions associated with the securities was determined on the basis of secondary data from the PCAF database.

Emissions avoided as a result of the financing afforded to renewable energy projects were calculated in a similar manner as that employed for the impact analysis for the Green Bonds issued by Rentenbank. For this purpose, the installed electricity generating capacity for each kind of generation was calculated on the basis of the outstanding amount and the average investment costs per kilowatt generated. In the next step, financed and avoided emissions were calculated on the basis of the average full-load hours and emission factors per kilowatt hour. Avoided emissions arise from increasing the share of renewable energy in the German energy mix. Further details can be found in the Impact Analysis.

Current GHG footprint

| Portfolio |

2024 | 2023 | ||||

| Net balance (in mEUR) | GHG emissions1 (in kt CO2e) |

Emission intensity1 (in kt CO2e/mEUR) | Net balance (in mEUR) | GHG emissions1 (in kt CO2e) |

Emission intensity1 (in kt CO2e/mEUR) | |

| Total |

38,888 |

21,042 |

0.54 |

40,922 |

22,642 |

0.55 |

| Agriculture |

14,876 |

18,298 |

1.23 |

15,508 |

19,616 |

1.26 |

| Forestry |

82 |

18 |

0.22 |

101 |

24 |

0.24 |

| Aquaculture and fisheries |

26 |

7 |

0,27 |

31 |

8 |

0,26 |

| Agribusiness and food industry |

3,733 |

2,255 |

0,6 |

4,084 |

2,483 |

0.61 |

| Renewable energy |

7,924 |

147 |

0,02 |

8,482 |

143 |

0.02 |

| Rural development |

12,056 |

309 |

0,03 |

12,486 |

353 |

0.03 |

| Residential real estate |

191 |

8 |

0,04 |

230 |

10 |

0.04 |

| Wertpapiere |

16,515 |

6.87 |

0,00 |

15,900 |

5 |

0.00 |

| Table 7: Overview of Rentenbank’s financed emissions | ||||||

Through its promotional activities, Rentenbank financed a total amount of 21,042 kt CO2 equivalents in 2024. This amount is 1600 kt less than in 2023 and is therefore an improvement. The reduction is solely attributable to the decrease in new promotional loans granted. The emission intensity declined from 1.26 kg CO2e to 1.23 kg per euro invested in the agriculture portfolio and from 0.55 to 0.54 per euro invested in the total portfolio.

One of the main goals until 2030 is to optimise data quality in order to establish a solid data basis for effective decarbonisation control. In the course of continuous optimisation of data quality and further publications or updates of projections by the German federal government, the bank’s decarbonisation methods will be continuously controlled and the data basis progressively adjusted.

Climate targets and reduction pathway

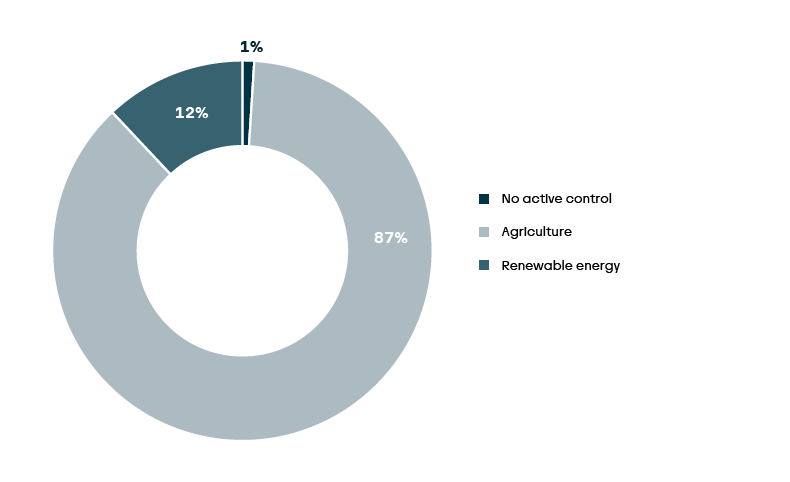

Rentenbank’s climate targets are sub-divided into reduction targets (focus on the Scope-1- and Scope-2-emissions of ultimate borrowers) and expansion targets. Because 87% of Rentenbank’s financed emissions are currently attributable to promotional loans to ultimate borrowers in agriculture, these loans represent the strategic focus of Rentenbank’s decarbonisation efforts. We would also like to step up our promotion of renewable energy expansion projects. In total, our control actions cover 88% of portfolio emissions (in line with international guidelines for target coverage).

Figure 9: Active control coverage (percentages of total emissions)

In the current development stage of its climate strategy, Rentenbank has not defined reduction targets for the other portfolios due to their low volume in monetary terms and their low emissions load. In particular, Rentenbank’s securities primarily comprise, now and in the future, liabilities to financial institutions whose Scope-1- and Scope-2-emissions are relatively low in comparison to the rest of the portfolio.

Reduction targets

Rentenbank’s climate strategy is focused on the attainment of our decarbonisation targets until 2030. Long-term targets until 2050 will be defined at a later time on the basis of compatibility with the Paris Climate Agreement; they are currently not yet available, particularly for agriculture.

Across its entire portfolio, Rentenbank will strive to achieve a 20% reduction until 2030. The reduction will be accomplished primarily through the planned actions in agriculture, but also through increased investments in renewable energy.

| Reduction targets | Emission intensity 2023 (in kg CO2e/EUR) |

Status quo 2024 | Traget 2030 (in % from base year 2023) |

Target 2030 (in kg CO2e/EUR) |

Reference scenario |

| Overall portfolio2 | 0.55 | 0.54 | -20% | 0.44 | / |

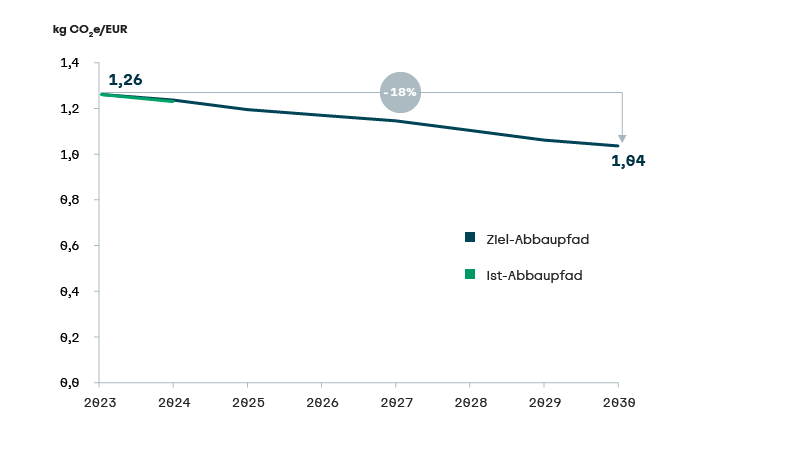

| Agriculture | 1.26 | 1.23 | -18% | 1.03 | Climate Action Act |

| Table 8: Emission reduction targets in banking activities | |||||

On this basis, it will be necessary to reduce emission intensity by 18%, from 1.26 kgCO2e/EUR (2023) to 1.03 kgCO2e/EUR by 2030. The emissions related to promotional loans in agriculture are composed of direct emissions in agricultural processes (Scope-1) and indirect emissions (Scope-2), most of which result from energy purchases. Accordingly, Rentenbank’s reduction target is derived on a weighted basis from the German federal government’s decarbonisation plans in the Climate Action Act (see Chapter 2.3) for agriculture and energy until 2030.

Expansion goals for climate protection of the Landwirtschaftliche Rentenbank

Figure 10: Reduction pathway agriculture

Expansion targets

Rentenbank also plans to avoid and sequester emissions to a greater extent by promoting renewable energy and natural climate change mitigation. The expansion targets for avoided and sequestered emissions are defined as cumulative targets until 2030.

|

Expansion targets |

Metric | Base year |

Actual |

Cumulative target 2023 bis 2030 | Degree of attainment |

| Renewable energy |

Saved ktCO2e |

2023 |

14,719 |

>45,000 |

35% |

| Natural climate change mitigation |

New business in mEUR |

2023 |

>111 |

>600 |

19% |

| Table 9: Expansion targets for avoided and sequestered emissions | |||||

Since 2023, Rentenbank’s financing of renewable energy projects has already avoided emissions of 14,719 ktCO2e (compared to the use of fossil energy).3 By 2030, Rentenbank plans to save another 30,200 ktCO2e by promoting renewable energy projects.

+++++++++++++++

Excursus on Natural Climate Change Mitigation

“Natural climate change mitigation actions are geared to preserve and strengthen as much as possible the climate change mitigation impact of terrestrial or marine ecosystems in conformance with the protection of biodiversity. These actions contribute both to the preservation of biodiversity and climate change mitigation. Thus, climate change mitigation is positioned at the interface between the preservation of biodiversity and climate change mitigation. Under this approach, actions are not regarded in isolation from each other; instead, synergies between climate change mitigation and the preservation of biodiversity are actively sought […]. Such actions are directed at natural habitats and populated areas.”

Definition of the German Federal Ministry for Environmental Protection and Consumer Protection (BMUV)

Additional information can be found in the BMUV’s Action Programme Natural Climate Change Mitigation.

+++++++++++++++

We see natural climate change mitigation as another lever for avoiding or sequestering emissions. This approach comprises forest preservation, reforestation, the rewetting of peatlands, and the preservation of grasslands. However, it is very difficult to quantify the emissions sequestration effect of our financing activities. We therefore plan to invest another EUR 600 million in total in promotional projects related to natural climate change mitigation until 2030. Our promotional activities in this area are geared to the action fields of the “Action Programme Natural Climate Change Mitigation” of the German Federal Ministry for Environmental Protection and Consumer Protection.

Ecosystems that contribute to natural climate change mitigation by means of carbon sequestration include forests, wetlands, soils, peatlands, bodies of water, grasslands, and nature parks in municipalities. For this reason, Landwirtschaftliche Rentenbank considers that investments in the following areas make contributions to natural climate change mitigation:

- Forestry

- Agroforestry systems

- Paludicultures

- Rewetting of peatlands

- Soil-conserving tillage techniques in agribusiness

- Organic farming