Business and risk strategies

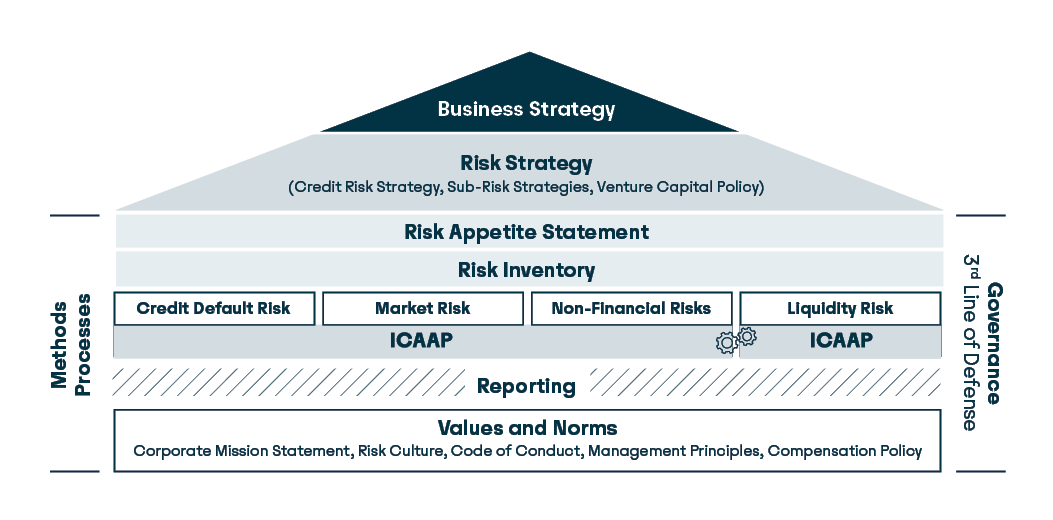

Rentenbank’s risk strategy is consistently derived from its business strategy. The risk strategy comprises both the general risk strategy and the sub-strategies related to specific risk types, as well as the Venture Capital Policy.

The Risk Appetite Framework comprises all strategies and guidelines, methods, processes, responsibilities, controls, and systems from which the risk appetite is derived, communicated, and monitored. Apart from minimum targets, alert thresholds, and limit systems, the Framework also includes an appropriate compliance culture and an actively practiced, appropriate risk culture.

The Risk Appetite Statement describes the extent to which the Bank is prepared to accept risks and allocate risk capital in order to achieve its strategic objectives. The risk appetite is defined on the basis of quantitative requirements and qualitative assertions. The requirements are concretised in the form of the limits and alert thresholds defined in line with the risk-bearing capacity.

The risk strategy, the Risk Appetite Framework, and the Risk Appetite Statement define the main risk management parameters established by the Management Board.

The credit risk strategy is shaped by the promotional mandate. To promote agriculture and rural areas, funding is only granted as a rule to banks domiciled in the Federal Republic of Germany or another EU country that conduct business with agricultural enterprises, enterprises in upstream or downstream sectors, or in rural areas. The special promotional loans are only granted to promote investments in Germany.

Rentenbank is also authorised to acquire equity interests, purchase shares in venture capital funds, and provide funding to the German federal states, German rural districts, and German municipalities in the form of promissory note bonds, registered securities, and bearer securities.

Thus, the Bank’s lending activity is limited to the funding of credit institutions and financial institutions as defined in Article 4 CRR and to providing capital to German local authorities.

In accordance with the Bank’s credit risk strategy, only a Rentenbank subsidiary may grant loans directly to enterprises. No such direct loans were granted in 2024.

Derivatives are only used as hedging instruments and are only concluded with business partners with whom Rentenbank has entered into a collateral agreement.

Rentenbank’s credit risk strategy demands a careful selection of business partners and products for all business activities. In accordance with its core competencies and business model, Rentenbank mainly choose banks and public-sector borrowers as business partners. By reason of its promotional mandate, Rentenbank is necessarily exposed to the banking sector as a sector concentration risk. As an indicator of the Bank’s risk profile, the average credit rating of the total loan portfolio should be at least A+, with due regard to product credit ratings.

One objective of the market risk strategy is the avoidance of interest rate risks that could lead to a decrease or loss in net interest income that would endanger the achievement of the Bank’s promotional goals. Furthermore, market risks are limited and managed on a present value basis. Foreign currency positions are closed as a basic rule.

The objectives of the liquidity risk strategy are to ensure the Bank’s solvency at all times, even under stress conditions, and to optimise the funding structure.

Non-financial risks, which include operational and strategic risks according to the Bank’s understanding, are managed with the goal of preventing losses by ensuring the quality of all the Bank’s operational processes. Compliance with regulatory requirements and the minimisation of reputation risks by means of appropriate communication management and a code of conduct are likewise components of the risk strategy.