Credit default risks

Definition

Credit default risk refers to the risk that a counterparty would not be able to fulfil its payment obligations, or only in part, as well as the risk of valuation losses due to the deterioration of credit ratings. This risk type is sub-divided into credit risk, migration risk, and country risk.

The Bank’s lending business is largely limited to the funding of credit institutions, institutions, and financial institutions according to the definitions of Article 4 CRR, as well as other interbank transactions. The credit risk inherent in the ultimate borrowers of special promotional loans lies with the local bank extending the loans. In addition, funding is provided to German federal states, German rural districts, and German municipalities.

Risk assessment and management

The central risk parameters for the determination of credit default risk are probability of default, loss given default, exposure at default, and the correlations between business partners, with the aid of which simultaneous defaults of business partners are simulated in the credit portfolio model.

The probability of default is derived from the credit ratings of the Bank’s business partners. The credit rating is assigned by way of an internal risk classification process under which individual business partners or transaction types are assigned to one of 20 credit rating categories. The best ten rating categories AAA to BBB- are reserved for business partners with low risks (“investment grade”). The seven rating categories BB+ to C signify latent or heightened latent risks, and the three rating categories DDD to D signify problem loans and business partners in default.

The credit ratings of our business partners are reviewed at least once a year on the basis of an analysis of their financial statements and financial position. For this purpose, key performance indicators, qualitative characteristics, the background of shareholders, and other supporting factors such as their affiliation with a protection scheme or state guarantee mechanisms are considered. The country risk of the business partner’s country of domicile is also considered in assessing the credit quality. For certain products such as German mortgage bonds (Pfandbriefe), the associated collateral or cover assets are considered as a further criterion, in addition to the respectively applicable national regulations, in determining the product rating. Whenever the Bank becomes aware of current information about negative financial data or a deterioration of the business partner’s business outlook, the credit rating is reviewed and adjusted if necessary.

The loss given default quantifies that portion of the exposure that would be irrecoverable after the default of a business partner and the realisation of collateral. To quantify its credit default risks, Rentenbank applies product-specific or transaction type-specific loss ratios determined on the basis of analytical and expert-based methods. In particular, the utilisation chain of the special promotional loans granted by way of on-lending is considered in the measurement and parameterisation of the loss given default for special promotional loans. Rentenbank also relies on external data sources in assessing specific transaction types.

The exposure at default corresponds to the net balance at the reporting date, plus off-balance sheet transactions with individual business partners. This indicator represents the residual value or market value of the exposure. In determining the amount of exposure under derivatives, a premium is added to account for market value fluctuations, with due consideration given to contractual netting clauses and any cash collateral furnished and received.

Under the Economic Approach, the credit value at risk is calculated by way of a credit portfolio model with due consideration given to correlations between business partners and migration risks.

The method described above makes it possible to measure, monitor, and manage risks in accordance with the MaRisk requirements. In this way, adverse developments and portfolio concentrations can be quickly identified and countermeasures initiated.

Limitation and monitoring

The maximum credit limit for all credit limits and a maximum limit for unsecured lines are set by the Management Board to limit credit default risks. Concentration risks are managed and limited at several levels of the Bank by means of various targeted concepts. In addition, country limits and currency transfer limits are set to limit the corresponding risks.

A limit system manages the amount and structure of all credit default risks. Internal limits are set for all borrowers, issuers, and counterparties and are sub-divided where appropriate for specific products and maturities. The Bank’s risk classification system is the central decision-making basis for the adoption of limits. In addition, certain minimum credit ratings have been established for individual transaction and limit types.

For risk-bearing capacity purposes, credit default risks are limited on the basis of the credit value at risk determined in the credit portfolio model.

In addition, risk indicators provide early indications of potential risk increases and risk shifts within the portfolio. Alert thresholds are established to quickly detect higher limit utilisation levels so that appropriate countermeasures can be taken.

Limits are monitored on a daily basis. Limit overruns are immediately reported to the Management Board.

Thus, credit default risks are managed, monitored, and reported for individual transactions at the borrower level and borrower unit level, at the country level, and at the level of the overall credit portfolio.

Portfolio overview

More than 90% of the Bank’s risk exposures are backed by collateral in the form of assignments of claims under funded loans to ultimate borrowers and state guarantee mechanisms. The Other risk exposures are likewise mainly secured products such as German mortgage bonds (Pfandbriefe) and covered bonds. Unsecured risk exposures largely consist of loans to and receivables from banks belonging to joint liability schemes in Germany (Haftungsverbünde).

The overall credit portfolio of EUR 92 billion (PY: EUR 95 billion) comprises the nominal amounts of risk exposures in euros, including special promotional loans with the corresponding assignments of claims under funded loans to the ultimate borrowers, state-guaranteed special promotional loans, registered bonds, promissory note bonds, securities, money market and derivative transactions, equity interests, venture capital investments, and all externally committed credit facilities, but not loans granted from the German federal government’s Special-Purpose Fund. The risk exposures of companies in which Rentenbank holds direct equity interests are included in the equity interests.

Derivative financial instruments may only be concluded as hedging instruments on the basis of a netting and collateral agreement.

In the three tables below, risk exposures are aggregated on the basis of country of domicile and at the level of the legally independent business partner without regard to Group affiliations. The risk exposures are assigned to credit rating categories on the basis of product ratings. The presented figures are based on nominal amounts.

The portfolio is secured at a rate of over 90%. It breaks down as follows:

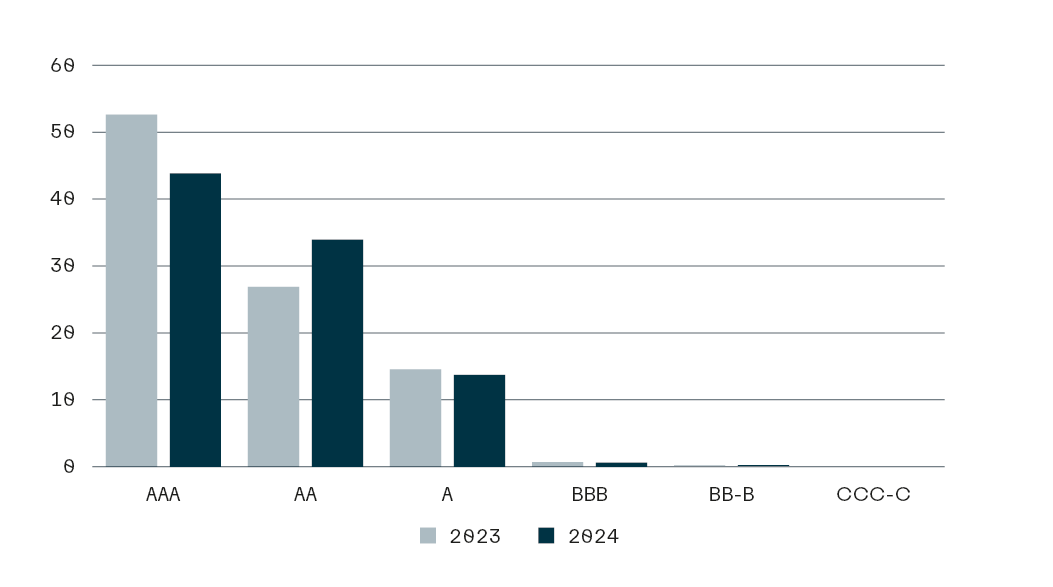

Credit Rating Categories (in euro billions)

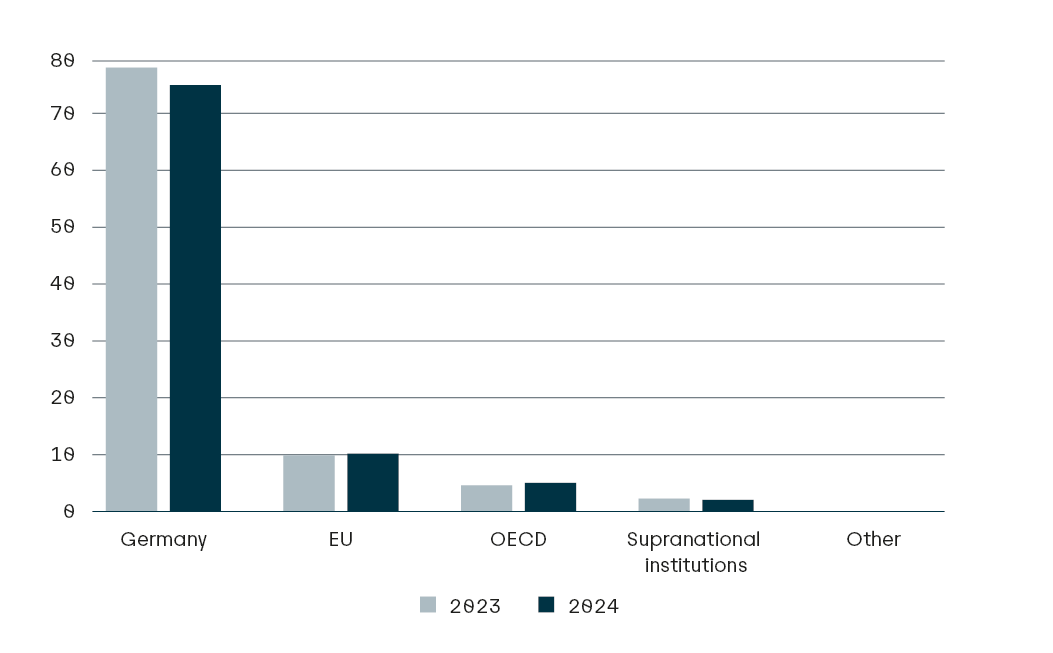

Country Groups (in euro billions)

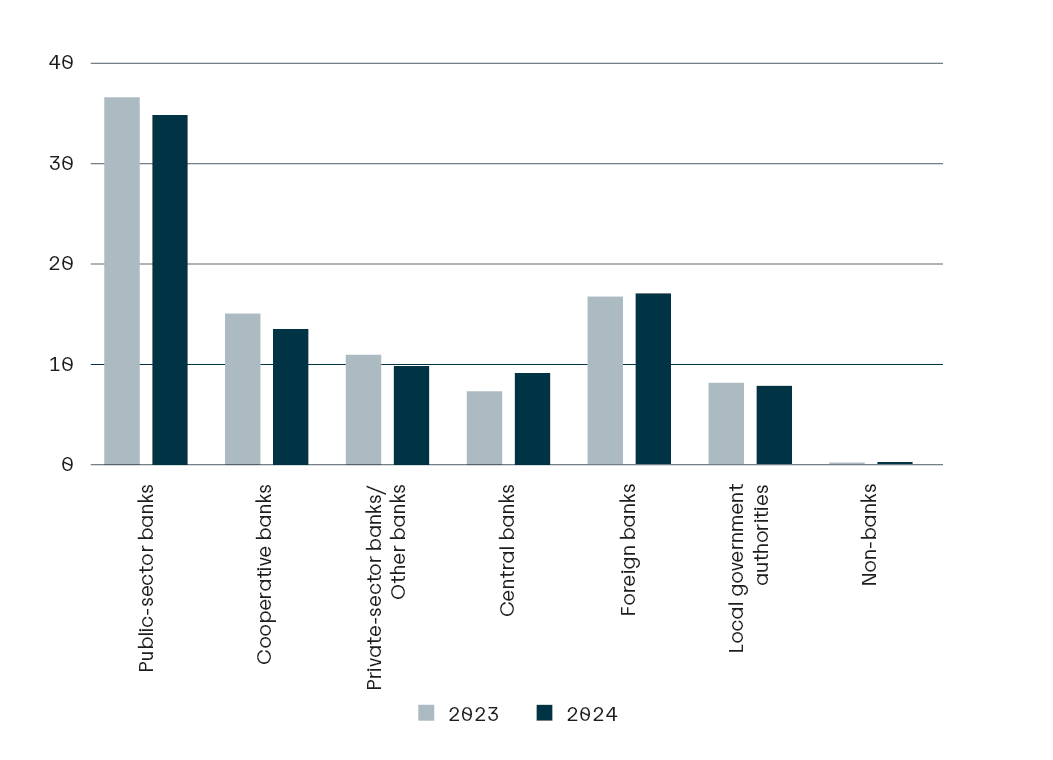

Counterparty groups (in euro billions)

Rentenbank has no exposure to Russian, Belorussian, or Ukrainian business partners or their subsidiaries. The exposure of Rentenbank’s business partners to Russia and/or Ukraine is very limited. Therefore, the direct effects of the Russia-Ukraine crisis on the business performance of the affected institutions are manageable on the whole. Rentenbank is also monitoring the current developments in Israel and Gaza. It does not see any effects on the Bank’s business partners at the present time.

Loan loss provisions

Specific valuation provision

The Bank assesses on a monthly basis whether there are any indications that not all payments of interest and principal can be made in accordance with the applicable contractual provisions. For financial reporting purposes, the necessity of recognising a specific valuation allowance in respect of a given loan receivable is assessed on the basis of the following criteria:

- “Non-investment grade” credit rating,

- non-performing, deferred, or restructured exposures,

- significant deterioration of the business partner’s credit quality,

- significant deterioration of the credit rating of the business partner’s country of domicile.

As in the previous year, it was not necessary to recognise specific valuation allowances at the reporting date.

Value corrections of venture capital equity investments

The venture capital funds are assigned to Fixed assets at Rentenbank. A value correction of EUR 0.3 million was made in one fund in 2024.

General valuation allowance

General valuation allowances are recognised to account for latent credit default risks. The amounts of such general valuation allowances are determined on the basis of the probability of default and the loss given default.

The general valuation allowances for loan receivables, securities, and irrevocable credit commitments amounted to EUR 3.1 million, negligibly lower than in the previous year (EUR 3.2 million).