Promotional programmes

Our promotional activity is centred on our special promotional loans. We increased the share of programmes aimed at promoting sustainable investment projects further in 2024. Such projects include investments in renewable energy, but also programmes that we conduct on behalf of the German federal government such as the Agriculture Investment Programme of the German Federal Ministry of Food and Agriculture (BMEL), which we completed as planned in 2024. Another one of our key objectives is to promote innovation.

The 2024 financial year was especially challenging for the issuance of new special promotional loans. The high EU base interest rate set at the beginning of the year coupled with the conditions of state subsidy law left Rentenbank little room to offer competitive market terms without subsidies. Consequently, commercial banks did not make use of Rentenbank’s resources to finance non-subsidy-eligible projects.

These conditions led to a considerable drop in demand for promotional loans particularly in the area of renewable energy because projects promoted in accordance with the German Renewable Energy Act (Erneuerbare-Energien-Gesetz, EEG) are only eligible for special promotional loans at non-subsidised terms. Similar effects were also observed in other promotional lines. For example, large corporations, which are likewise only eligible for special promotional loans at non-subsidised terms, filed a lower number of loan applications. The Agribusiness and Food promotional line was especially impacted by this trend. Moreover, the agriculture sector was characterised by investment restraint, like nearly all economic sectors in Germany.

Under these conditions, the volume of new promotional loans issued by Rentenbank fell by 41.1% to EUR 3.6 billion in 2024. The number of special promotional loans granted fell to 10,948 (2023: 14,534).

New special promotional loans (in euro millions)

| Promotional line | 2024 | 2023 |

| Agriculture | 1,438 | 1,597 |

| Forestry | 6 | 7 |

| Aquaculture and fisheries | 1 | 1 |

| Agribusiness and food | 345 | 746 |

| Renewable energy | 76 | 849 |

| Rural development1 | 1,736 | 2,913 |

| Total | 3,602 | 6,114 |

Differences from the total sum are due to rounding.

Extensive promotion of sustainability projects by the bank’s special promotional loans

The transformation to a more sustainable economy is a mission for the whole of society and one that demands investments on a commensurate scale. We support sustainable investments in agriculture with our special promotional programmes and an interest rate subsidy (best terms and premium terms). The “Energy from the Countryside” programme promotes the expansion of renewable energy. The programme is focused on promoting investments by farmers in photovoltaic, biogas, and wind energy generation, as well as civic wind farms in rural areas.

With its “Sustainability”, “Environmental and Consumer Protection”, and “Forestry” programmes, Rentenbank supports a wide range of measures to improve animal welfare, energy efficiency, and emissions reduction. Other objectives of these programmes include the promotion of ecological farming, forestry measures such as the conversion of forests to climate-adapted mixed forests.

We financed sustainable projects with funds totalling EUR 365 million in the 2024 financial year (2023: EUR 1.3 billion). Thus, 10% of our new promotional lending consisted of special promotional loans to finance sustainable investments.

Sustainable investments (in euro millions)

| 2024 | 2023 | |

| Renewable Energy promotional line | 76 | 848 |

| Humane animal husbandry | 121 | 78 |

| Emissions reduction | 64 | 240 |

| Energy efficiency | 21 | 37 |

| Ecological farming | 46 | 50 |

| Other | 37 | 62 |

| Total | 365 | 1,314 |

| Share of total new promotional loans (in %) | 10 | 21 |

Differences from the total sum are due to rounding.

Expansion of the promotional programme “Areas of Future Development”

Rentenbank is continually expanding its promotional programme “Areas of Future Development” in order to promote sustainable investments in agriculture and rural areas even more. The areas of future development are selected topics which Rentenbank has identified as being especially worthy of promotion and/or innovative on the basis of the current social and political discourse. The loans offered under this programme feature additionally subsidised premium terms. The programme is flexible and can be adjusted as needed.

We broadened the programme in 2024 by adding two more areas of future development, bringing the total to eight. One of these new areas involves the promotion of investments to rebuild stalls to improve animal welfare. The second new area involves the promotion of investments in machinery to facilitate autonomous, environmentally friendly farming practices.

Under the “Areas of Future Development” programme, we promoted investment projects with 300 loans totalling EUR 89.9 million at premium terms in the past financial year (2023: 167 loans totalling EUR 80.0 million).

Only modest decrease in new promotional loans in the Agriculture promotional line

The 9.9% year-on-year decrease in the volume of new promotional loans granted in the Agriculture promotional line was relatively modest compared to the other promotional lines. At EUR 588 million, machinery investment accounted for the largest share of the total financing volume (41%) in 2024, followed by farm buildings in the amount of EUR 507 million, representing 35% of the total financing volume. Land acquisition financing amounted to EUR 237 million or 16%.

The total volume of loans granted under our liquidity protection programm, which is also part of the Agriculture promotional line, was only EUR 1.7 million in 2024, as the demand for this type of loan was very weak. We opened the programme permanently to damage caused by regionally occurring extreme weather events in the past financial year.

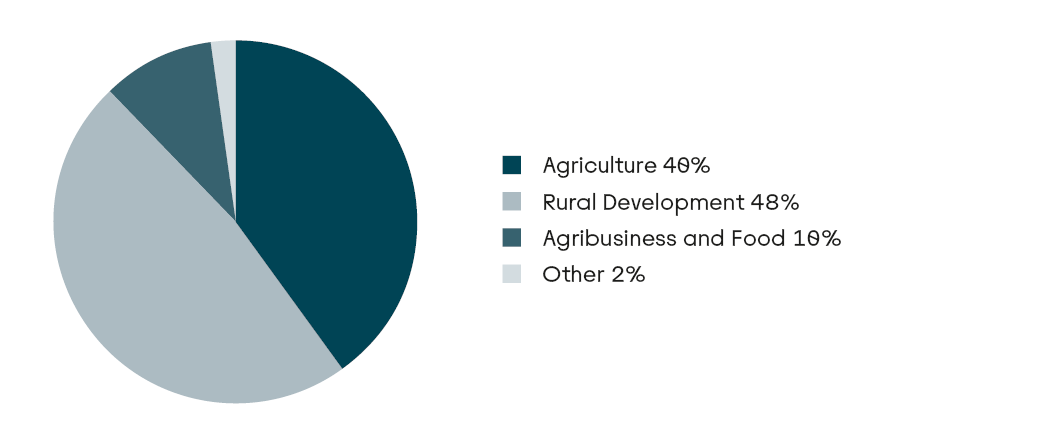

New promotional loans granted in 2024 (Total EUR 3.6 billion)

BMEL’s “Agriculture Investment Programme” concluded at year-end 2024

We successfully continued the programme entitled “Investment Promotion under the Investment and Future Programme for Agriculture” on behalf of the BMEL in the 2024 financial year. This programme, which was scheduled to run four years in total, was concluded at the end of 2024.

During the term of the project, more than 14,800 applications for a total grant volume of more than EUR 532.5 million were approved.

The objectives of this programme were to promote resource-conserving land management, better climate and environmental protection, and improved biodiversity. Machinery and equipment used in the more exact application of livestock manure and plant protection agents and in mechanical weed control were promoted under the programme. Structural installations for the low-emissions storage of livestock manure and liquid manure separation systems were also eligible for promotional loans.

Not only agricultural enterprises, but also agricultural contractors and commercial machinery rings were eligible to apply for such loans. Investment projects were supported with a subsidy of up to 40% of the total investment amount, combined with a low-interest promotional loan by Rentenbank to finance the rest.

In the last year of the programme, we approved loans totalling EUR 10.6 million and investment subsidies totalling EUR 16.9 million for investments in environmentally friendly and climate-friendly projects. All disbursement applications received were processed in time before the end of the project. Funds totalling EUR 104.5 million were disbursed in 2024.

Support of the Environment Ministry’s “Natural Climate Protection” programme (ANK)

Since July 2024, we have been conducting the grant programme entitled “Promotion of Investment in Machinery and Equipment to Strengthen Natural Soil Functions in Agricultural Landscapes” as part of the German Federal Environment Ministry’s Natural Climate Protection Action Programme (Aktionsprogramm Natürlicher Klimaschutz, ANK).

The German federal government’s objective in launching the ANK programme is to considerably improve the general condition and resilience of eco-systems in Germany in order to strengthen their climate protection performance and so make a lasting contribution to climate protection.

Location-adapted and sustainable soil management preserves natural soil functions and promotes soil biodiversity and thus makes an important contribution to natural climate protection. The programme promotes investment in machinery and equipment to enhance the carbon sink function of soils and biodiversity in agricultural landscapes, particularly machinery and equipment designed for soil-conserving land management and reduction of soil pressure, mechanical weed control, and extensive grassland management.

Not only agricultural enterprises, but also agricultural contractors, commercial machinery rings, and recognised nature protection associations are eligible to apply for such loans. Investment projects are supported with a subsidy of up to 65% of the total investment amount, which can be optionally combined with a low-interest promotional loan by Rentenbank to finance the rest.

Since the start of the expression-of-interest procedure in July, many agricultural enterprises have demonstrated their willingness to make investments of the kind covered by the programme. Rentenbank invited interested parties to file applications in three rounds and approved 222 applications for a grant volume of more than EUR 7.7 million by the end of the year.

Lower volume of new promotional loans in the Agribusiness and Food promotional line

The significant decrease in the volume of new promotional loans granted in the Agribusiness and Food promotional line is mainly attributable to the high level of the EU base interest rate, which had the effect of lowering demand for non-subsidised loans by large corporations because they can only be promoted with non-subsidised loans. At EUR 284 million, machinery investment accounted for the largest share (82%) of total new loans in this promotional line, followed by the financing of farm buildings in the amount of EUR 52 million, representing 15% of total new loans.

Lower demand for loans in the Rural Development promotional line

The performance of the Rural Development promotional line was mainly affected by the demand of state development banks for Rentenbank’s global loans in the amount of EUR 1.4 billion, which represented 80% of the new loans granted in this promotional line. These funds were used particularly to promote local infrastructure projects in rural areas. The decline is best understood in relation to the very high number in the previous year. Nevertheless, investment propensity was generally lower in this promotional line due to the current market conditions.

Greenhouse gas footprint of promotional programmes

Since 2023, Rentenbank has measured the CO2e emissions linked to its promotional programmes (Scope 3, Category 15) using PCAF (Partnership for Carbon Accounting Financials). These emissions account for more than 99% of Rentenbank’s total emissions. We financed approximately 21,042 kt CO2e with our promotional programmes in 2024, which is lower by 1,600 kt than in 2023 and therefore an improvement. This reduction is not entirely attributable to the lower volume of new promotional loans granted as the emission intensity declined by 0.55 kg CO2e per invested euro to 0.54 kg.

Rentenbank's emissions

| Portfolio | 2024 | 20231 | ||||

| Net amount (in mEUR) | GHG-Emissionen2 (in kt CO2e) |

Emission intensity3 in (kt CO2e/ mEUR) |

Net amount (in mEUR) |

GHG- emissions4 (in kt CO2e) |

Emission intensity5 |

|

| Total | 38,888 | 21,042 | 0.54 | 40,922 | 22,642 | 0.55 |

| Agriculture | 14,876 | 18,298 | 1.23 | 15,508 | 19,616 | 1.26 |

| Forestry | 82 | 18 | 0.22 | 101 | 24 | 0.24 |

|

Aquaculture and fisheries |

26 | 7 | 0.27 | 31 | 8 | 0.26 |

| Agribusiness and food | 3,733 | 2,255 | 0.6 | 4,084 | 2,483 | 0.61 |

|

Renewable energy |

7,924 | 147 | 0.02 | 8,482 | 143 | 0.02 |

|

Rural development |

12,056 | 309 | 0.03 | 12,486 | 353 | 0.03 |

|

Residential real estate |

191 | 8 | 0.04 | 230 | 10 | 0.04 |

Due to the fact that investments are assigned to NACE codes, which are part of the classification system for economic sectors in the EU, and the corresponding CO2 intensities, the portfolios used for CO2 computation do not match the promotional lines. For example, the agricultural machinery of contractors is included in the agriculture portfolio, but are assigned to the Agribusiness and Food promotional line. The purpose of using NACE codes is to assign the most exact CO2 intensity possible to each investment irrespective of the promotional line.

Most of the financed emissions are attributable to the agriculture portfolio. Agriculture emits large quantities of methane and nitrous oxide, which have a higher greenhouse gas potential than CO2 and therefore make a considerable contribution to climate change. Because they result in large part from natural bio-chemical processes, they can only be reduced to a limited extent.

Because our customers’ emissions data are not yet available to us, the presentation of financed emissions is mainly based on secondary data from the PCAF database and is therefore somewhat inexact. In order to have a solid data basis for effective decarbonisation control, we will seek in the coming years to progressively expand the pool of data available to us for calculating our CO2 footprint. Additional information on the subject of financed emissions, including the calculation and planned reduction of financed emissions, can be found in the Climate Strategy.